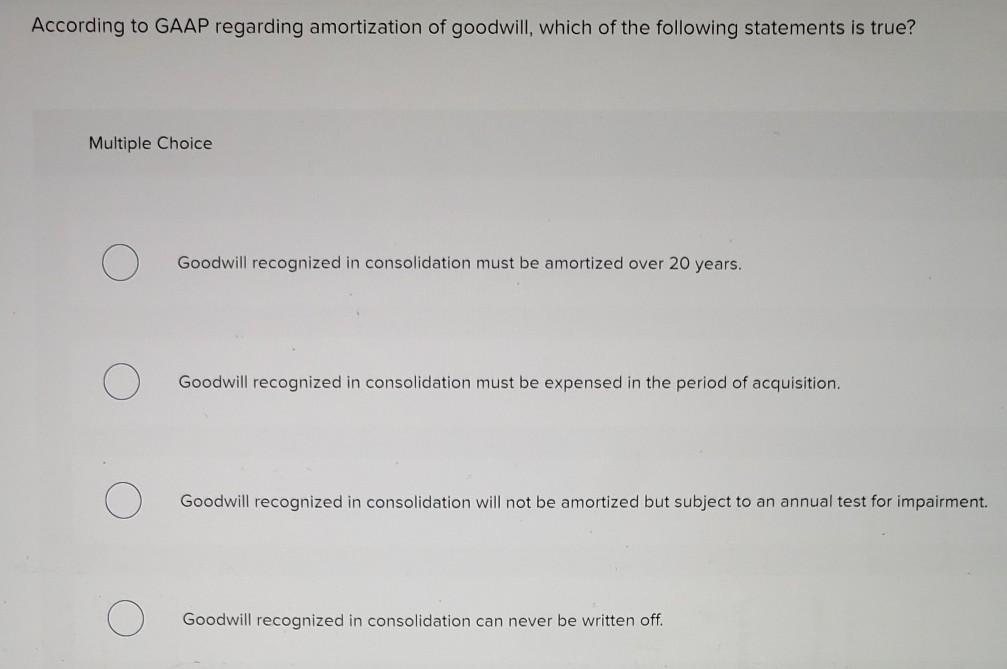

According to Gaap Regarding Amortization of Goodwill

Goodwill recognized in consolidation must be expensed in the period of acquisition. Goodwill recognized in consolidation can never be written off.

Amortization Of Intangible Assets Formula And Excel Calculator

The concept of goodwill amortization leads to inaccurate accounting results and is not compatible with the premise of going concern inherent in the consideration paid to acquire nearly all businesses.

. According to GAAP regarding amortization of goodwill and other intangible assets which of the following statements is true. Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment. B Goodwill recognized in consolidation must be expensed in the period of acquisition.

This lengthy period was set to allow a minimum impact to the net income McClenahen 2001. Goodwill amortization over a maximum of twenty years should be used. In 2018 FASB invited public comments on accounting for goodwill.

Goodwill recognized in consolidation must be expensed in the period of acquisition. A Goodwill recognized in consolidation must be amortized over 20 years. 2 rows GAAP accounting.

Goodwill recognized in consolidation must be amortized over 40 years. C Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment. FASB Accounting Standards Update No.

However ASU 2014-02 IntangiblesGoodwill and Other Topic 350. In July 2020 it began initial deliberations regarding making changes to the accounting based on the comments received. Under the initial value method when accounting for an investment in a subsidiary The investment account remains at initial value.

Private company GAAP allows the company the option of amortizing goodwill over 10 years unless a shorter period of time is. A Goodwill recognized in consolidation must be expensed in the period of acquisition. On October 24 2018 the Board decided to add to its technical agenda a broad project to revisit the subsequent accounting for goodwill and the accounting for certain identifiable intangible assets.

Goodwill recognized in consolidation must be amortized over 20 years. Multiple Choice Goodwill recognized in consolidation must be amortized over 20 years. The FASB on December 16 2020 tentatively said it would require public companies to amortize goodwill over a 10-year period on a straight-line basis only without exception.

According to GAAP regarding amortization of goodwill which of the following statements is true. Goodwill recognized in consolidation must be amortized over 20 years. Impairment BVWire Issue 205-5 October 30 2019.

This modification essentially changed goodwill to a definite-lived intangible asset and set incremental amortization over this expected useful life. B Goodwill recognized in consolidation must be expensed in the period of acquisition. If your company has GAAP-basis financial statement with goodwill there is a new goodwill amortization option which is effective for annual periods beginning after December 15 2014 and interim periods beginning after December 15 2015.

The changes in ASU 2011-08 and ASU 2017-04 both fall within the framework of the nonamortization approach initially advocated by FASB in SFAS 142. Goodwill recognized in consolidation will not be amortized. Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment.

Private companies can elect to amortize goodwill on a straight-line basis over 10 years or less than 10 years if a company can support that another useful life is more appropriate. View Test Prep - Chap003 59 from MGMT 101 at University of California Los Angeles. Accounting for Goodwill allows these companies to use straight-line amortization of goodwill for up to.

Goodwill Amortization Is Not Decision Useful Goodwill amortization if adopted provides no informational utility. Under GAAP book accounting goodwill is not amortized but rather. On July 9 2019 the staff issued an Invitation to Comment Identifiable Intangible Assets and Subsequent Accounting for Goodwill to obtain formal.

C Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment. By Denise Lugo. Goodwill recognized in consolidation must be amortized over 20 years.

Goodwill recognized in consolidation must be expensed in the period of acquisition Goodwill recognized in consolidation will not be amortized but subject to an annual test for. According to GAAP regarding amortization of goodwill which of the following statements is true. Pooling is Eliminated In July 2001 the Financial Accounting Standards Board FASB released SFAS 141 Business Combinations and SFAS 142 Goodwill and Other Intangible Assets.

Accounting for Goodwill A consensus of the Private Company Council contains significant change in subsequent accounting for goodwill. Goodwill recognized in consolidation must be amortized over 20 years. According to GAAP regarding amortization of goodwill and other intangible assets which of the following statements is true.

A Goodwill recognized in consolidation must be amortized over 20 years. According to GAAP regarding amortization of goodwill and other intangible assets which of the following statements is true. B Goodwill recognized in consolidation will.

According to GAAP regarding amortization of goodwill and other intangible assets which of. Amortization of the excess of fair value allocations over book value is ignored in regard to the investment account. The FASB Boards most recent discussion focused on an appropriate amortization methodology.

According to GAAP regarding amortization of goodwill which of the following statements is true. According to GAAP regarding amortization of goodwill and other intangible assets which of the following statements is true. D Goodwill recognized in consolidation can never be written off.

2014-02 IntangiblesGoodwill and Other Topic 350. According to GAAP regarding amortization of goodwill and other intangible assets which of the following statements is true. Deliberations included the use of amortization.

Goodwill recognized in consolidation must. D Goodwill recognized in consolidation can never be written off. Goodwill recognized in consolidation must be amortized over 20 years.

The board said that for an amortization period a companys management can deviate from the default period if management could justify the reasons for doing so. Goodwill recognized in consolidation will not be amortized but subject to an annual test for impairment. Arguments in favor of goodwill amortization premised on investors use of adjusted earnings are in this authors view hollow and a capitulation of GAAP metrics in favor of non-GAAP metrics.

Diverse feedback to FASB regarding goodwill amortization vs.

Goodwill Amortization Gaap Vs Tax Accounting

Goodwill Amortization Gaap Vs Tax Accounting

Solved According To Gaap Regarding Amortization Of Goodwill Chegg Com

No comments for "According to Gaap Regarding Amortization of Goodwill"

Post a Comment